Putting Bernanke's words into action, since early August of 2007, the Fed has stepped up to the plate with tens of billions of dollars. On November 15 alone, the Fed injected almost $50 billion into the banking system, the largest single-day cash infusion since 9/11.

Then, on December 12, the Fed announced that it would open the spigots by providing lending $28 billion created out of nowhere to the nation's banks in exchange for a "wide variety of collateral."

In other words, the Fed will accept as collateral even the very same toxic waste paper now bedeviling the financial system.

And that's just one of many ways that the government is scrambling to keep the house of cards from falling. For instance, there are 12 Federal Home Loan Banks (FHLBs) whose job it is to serve as "lenders of last resort" by making cash available to banks and other financial institutions.

In the third quarter of 2007 alone, FHLB loans skyrocketed to a record $746.2 billion, nearly 18 times the yearly average between 2003-2006.

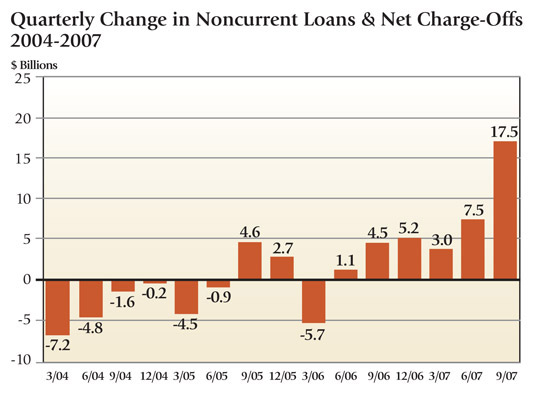

That alone should tip you off to how serious the government considers the current credit crisis to be. And no wonder. The following chart shows the steeply worsening increase in non-performing bank loans and outright charge-offs.

Faced with the very real threat of a deep recession caused by a freeze-up in credit, falling home values and soaring loan defaults, the Fed is left with a rock-and-a-hard-place decision. Hold tight and let the economy fall... hard. Or, open the money spigots wide in an attempt to maintain liquidity in the markets, sacrificing the dollar in the process.

Given two untenable choices, it is our view that the government will continue on the path of a loose monetary policy, the implications of which are not hard to figure out.

Sticking with the helicopter metaphor for a moment longer, creating billions of new dollars out of thin air to smooth over a litany of problems caused by decades of irresponsible debt creation is analogous to a helicopter trying to put out a raging forest fire by dropping tank loads of gasoline.

In other words, the "solution" is more of the same. It is only making the situation worse.

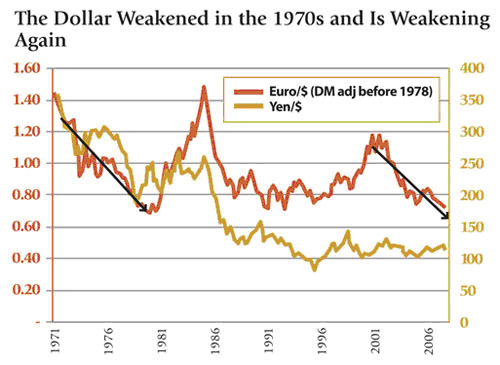

The result is simply this: as more and more dollars are created and injected into the economy, the purchasing power of all the dollars in circulation comes under pressure. It's called inflation. The last time we saw anything like what we are seeing today was in the 1970s. Here's a snapshot of the dollar against foreign currencies, then and now. The parallels are eye-opening.

You don't need me to tell you that, regardless of what the Fed would like you to think, inflation is already a problem. Yesterday I paid $3.10 for a gallon of gas, $7.50 each for movie tickets, and just shy of $30 for two cheese Stromboli's following the show.

Since March 2002, the U.S. Dollar Index, which measures the value of the dollar against a basket of six major currencies, has fallen 35.3%. The downtrend in the U.S. dollar is far from over.

Balancing Risk

Once you've identified the problem, identifying how to balance the risk to your portfolio is easy. In times of inflation, people turn to tangible "stuff." Viewed in that context, it is perfectly understandable why oil, gold and other commodities have been moving higher.

And, just as the U.S. dollar has farther to fall, so do the commodities have farther to rise. On that point, JPMorgan went on record a few days ago with their forecast that of all the commodities, they expect precious metals to be the strongest in 2008... followed by agricultural products, base metals and energy.

We think JPMorgan has it right, and that of all the possible portfolio diversifications you can make today in an attempt to protect your overall portfolio and to profit over the coming year, few will serve you better than gold.

No comments:

Post a Comment